| | Business

[ 2016-09-01 ]

Banks threatened by mobile money service – PwC survey

At a time that calls for collaboration between

banks and telcos in the provision of mobile money

services intensify, it appears banks are rather

concerned about the threat posed by mobile money

services.

For instance the August 2015 Telecom Subscriptions

Report by the National Communications Authority

(NCA), posits that mobile money made significant

strides between 2012 and 2015.

According to the report, registered subscribers

increased from 3.8 million to 13.1 million while

registered agents also increased over tenfold from

8,660 to 79,747 within the three year period.

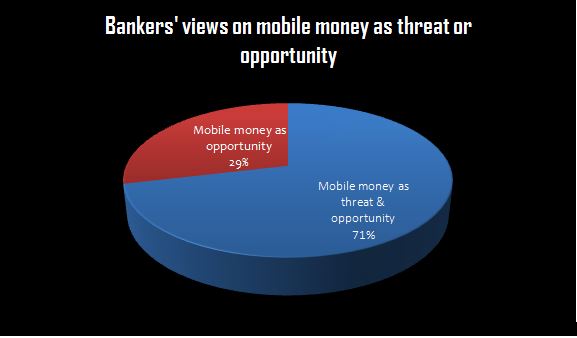

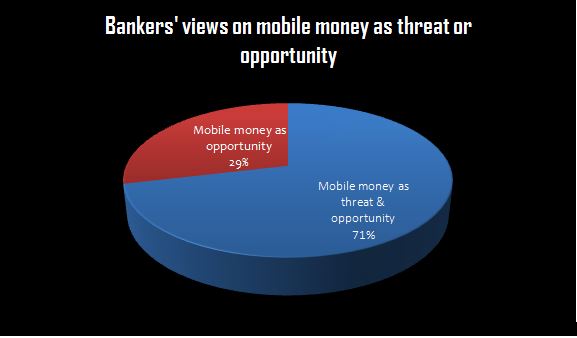

A recent survey by Pricewaterhouse Coopers [PwC]

indicated that over 70 percent of CEOs and Heads

of e-banking services in Ghana view mobile money

as both a threat and at the same time an

opportunity.

Also, about 56 percent of banks are of the view

that mobile money presents threats to the

traditional ways in which the industry operates,

even if these threats do not measure up to the

opportunity.

The report captioned, “How to win in an era of

mobile money,” surveyed CEOs, CFOs, and Heads of

E-banking of 25 out of a total of 30 banks.

The threats as viewed by the bankers were the

relatively cheaper or no costs telcos charged on

services such as of bills or services offered in

restaurants and items purchased in certain shops.

Even though about 29 percent of the participants

viewed mobile money as an opportunity which has

generally enhanced the delivery of services such

as domestic remittances and bill payments, 71

percent of the respondents view mobile money as

both an opportunity and a threat to their

operations.

The bankers also argued that the E-Money Issuer

(EMI) Guidelines of the BoG have set the stage for

a possible entry into the banking arena by

telcos.

As a result, the bankers believe that the telcos

will at that point become direct competitors to

banks instead of partners and service providers to

the industry.

Regulatory regime necessary

Commenting on the development, the Senior Vice

President, Strategic Planning at Royal bank, Dr.

Kwame Baah Nuako, told Citi Business News

regulation is key to foster the collaboration

between telcos and banks.

“My argument is that you cannot have one part of

the banking space that is the universal bankers

being regulated while another part that is the

telcos also engaging in banking, not being

regulated,” he opined.

For Buddy Broukou of the financial inclusion think

tank, the Consultative Group to Assist the Poor

[CGAP], Ghana is less likely to see the mobile

money take over traditional banking.

“I would say no because the two services are

operating independently…if you take the case of

Ghana where there is high banking penetration and

relatively low mobile money penetration, that has

been more a function of regulatory environment,”

she remarked.

Meanwhile the banks believe three key things,

regulation, technology and partnerships together

with other conditions will propel them to win in

the era of mobile money.

Mobile money quick facts

Between 2012 and 2015, the number of transactions

increased substantially from 18 million to 266

million while the value of transactions equally

went up from GH¢594 million to GH¢35 billion.

Also, by the end of 2015, the mobile money balance

on float stood at GH¢548 million.

The Bank of Ghana’s Payment and Settlement

Department however reports that the figure

increased by about 24 percent as at the end of

June this year.

According to the central bank, the mobile money

balance on float increased from the GH¢548

million to GH¢679 million.

Source - citibsinessnews.com

... go Back | |